nanny tax calculator texas

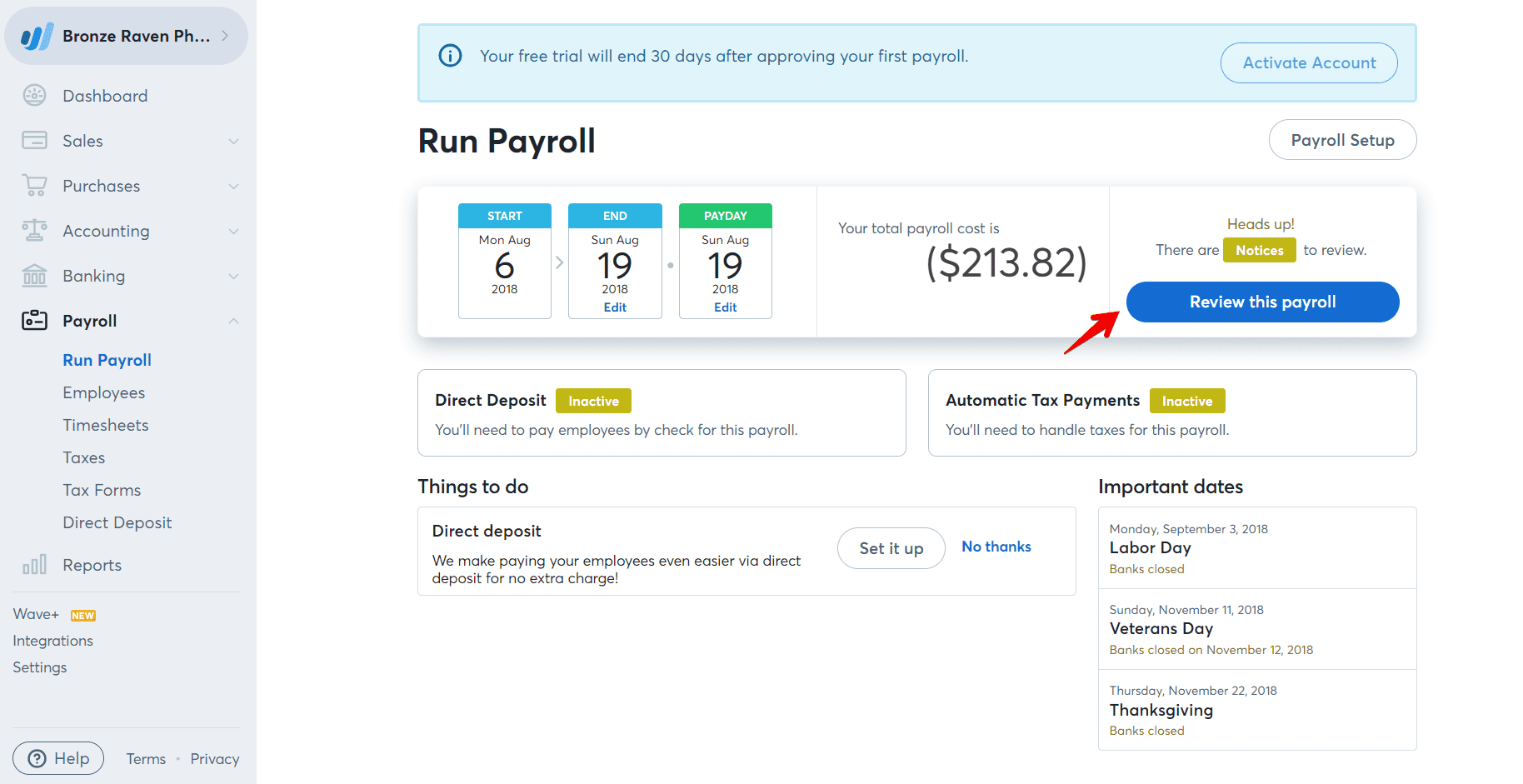

These taxes apply even if you hired your nanny through an intermediary like a service or website. Using a nanny payroll service can greatly reduce the amount of time it takes you to pay your nanny withhold your nannys taxes file your own taxes and stay up-to-date on state and federal changes to tax laws to ensure youre always in compliance.

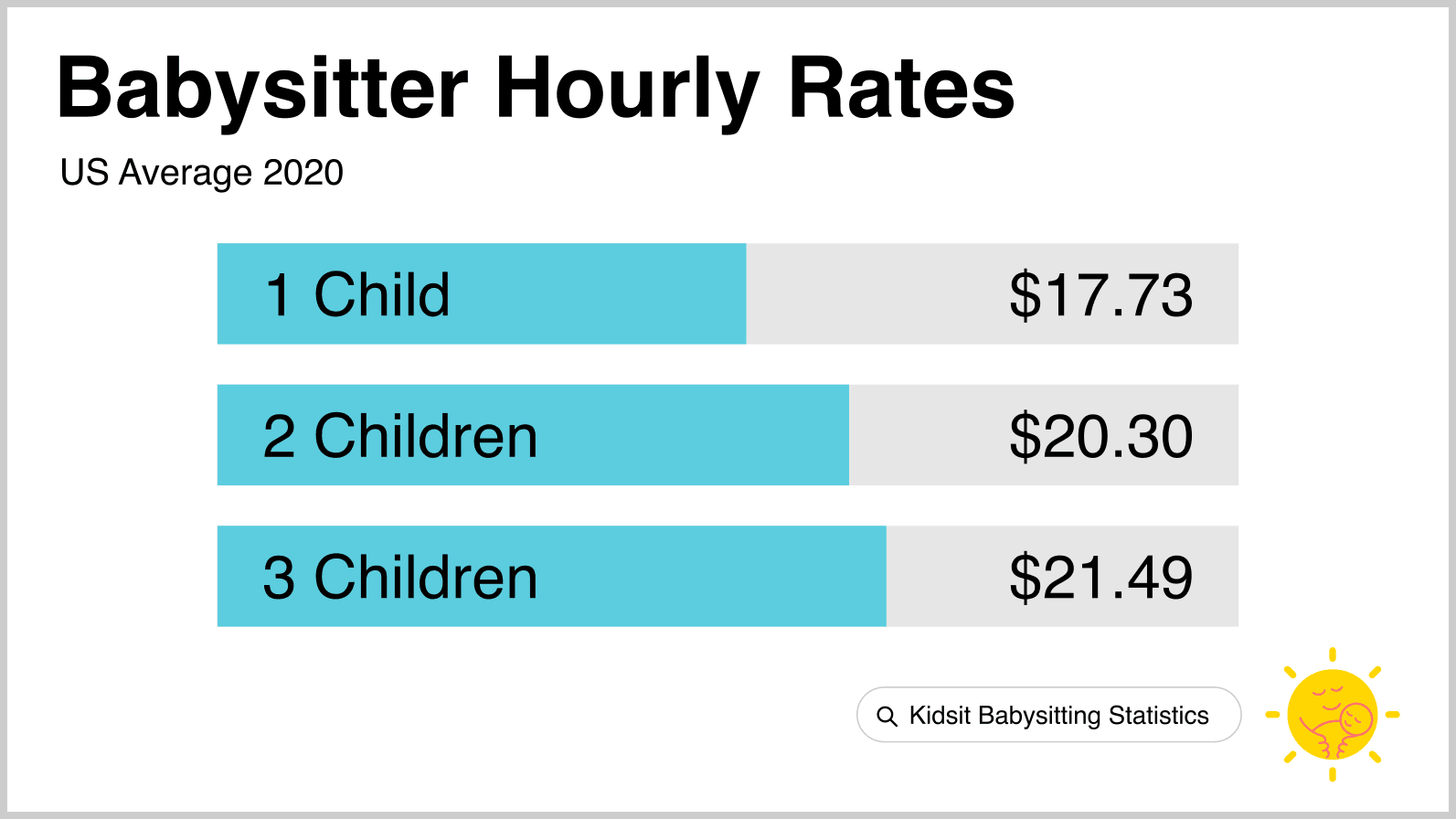

Babysitting Pay Rates How Much Should You Charge

The Tax Foundation is the nations leading independent tax policy nonprofit.

. Calculations are based on the latest available federal and state withholding tables. You can certainly pay your nanny and calculate end-of-year taxes for both of you on your own but unless youre an. We use the Consumer Price Index CPI and salary differentials of over 300 US cities to give you a comparison of costs and salary.

They are ideally looking for an experienced candidate who would be happy to babysit their two. Telephone or email support is only available to paid SCS clients. The federal minimum wage rate was raised to 725hour in 2009.

Local taxes are not calculated. To get a better idea of what a nanny will cost in your area use our babysitting rates calculator. This website contains information links images and videos of sexually explicit material collectively the Sexually Explicit Material.

Nannies and other household employees are covered by the Fair Labor Standards Act which means they must be paid the prevailing minimum wage rate. As a quick example a nanny in Brooklyn New York currently will earn about 20 an hour while a nanny in San Antonio Texas will earn about 1475. A free inside look at company reviews and salaries posted anonymously by employees.

A lovely family in the Westminster area needs an initiative driven full time live in housekeeper toSee this and similar jobs on LinkedIn. Perfect Household Staff has been delivering outstanding worldwide Domestic Recruitment and Household Management Services to an impressive list of some of the worlds most distinguished individuals and families including high profile figures from the world of finance politics celebrity and royalty. Minimum wage rates are on the rise for 2022 in many states counties and cities across the country.

Stock Market News - Financial News - MarketWatch. Let us help you make an informed decision about what it will cost to live and work in the city of. According to our latest State of Safety survey Hoosiers daily level of concern about safety and security is lower than the national average IN 44 vs.

This tax has a maximum capthe wage baseof 142800 in earnings for the 2021 tax year. For over 80 years our goal has remained the same. The perfection period is a grace period of five days for 1040 returns and Form 4868 extensions.

Some families opt to use a payroll. 1425hr Rate information as of 6162022. Who are the PERFECT HOUSEHOLD STAFF Team.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. It increases to 147000 in 2022. Personal finance teaching aid.

Our team of highly. 50 of Indiana residents feel concerned about property crime and package theft comes in a close second at 49. The amount that appears in box 3 of your Form W-2 should not be more than 142800 in the 2021 tax year for this reason.

A family based in Putney London seeks a full time live out housekeeper to maintain the excellent state of their property. You should note that the grace period of five days is available to only those who filed their tax return timely. So for example the tax year 2019 for which filing deadline is 15th April 2020 the perfection period will end on April 25 2020.

San Antonio Texas. You only have to pay the Social Security tax on compensation and earnings up to this amount. I you are not at least 18 years of age or the age of majority in each and every jurisdiction in which you will or may view the Sexually Explicit Material whichever is higher the Age of Majority ii such material offends.

Posted 33903 AM. A free inside look at company reviews and salaries posted anonymously by employees. Hoosiers worry less about violent crime 45 and gun violence 44 which makes.

How will changes in my income deductions state change my take home pay. If you arent sure how much nanny taxes are in your state this nanny tax calculator can give you an idea of what youll need to pay. To improve lives through tax policies that lead to greater economic growth and opportunity.

Do NOT continue if.

Caregivers How To Handle Unethical Requests From Your Boss Caregiver Nanny Jobs Childcare Jobs

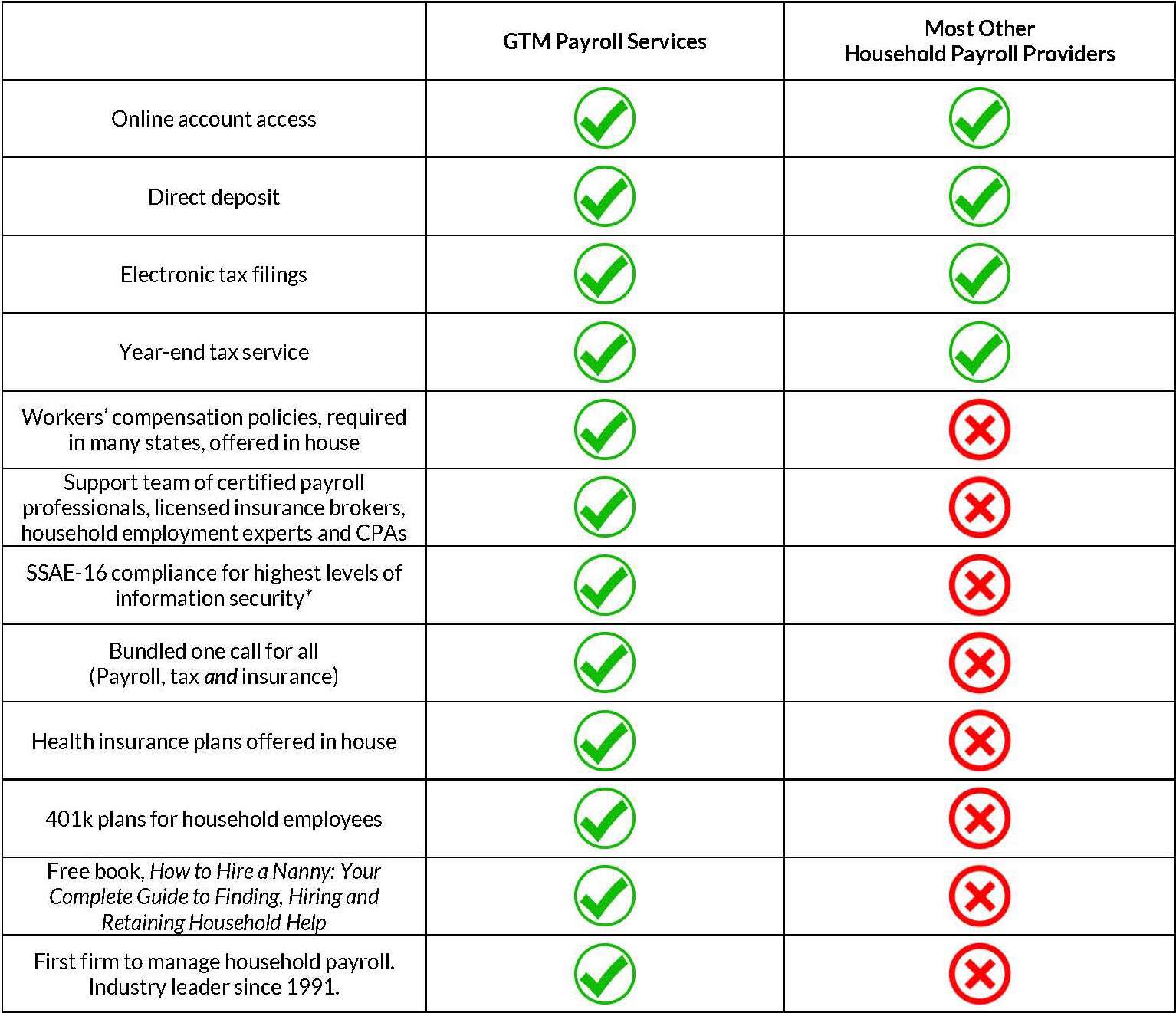

Nanny Payroll Service Comparison Gtm Payroll Services

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

How To Keep Your Nanny Tax Clients Happy

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Payroll Services For Households Adp

Deducted A Nanny As A Business Expense Homework Solutions

Retaining Your Nanny When You Find The Right Caregiver

The 10 Best Nanny Payroll Services 2022 The Baby Swag

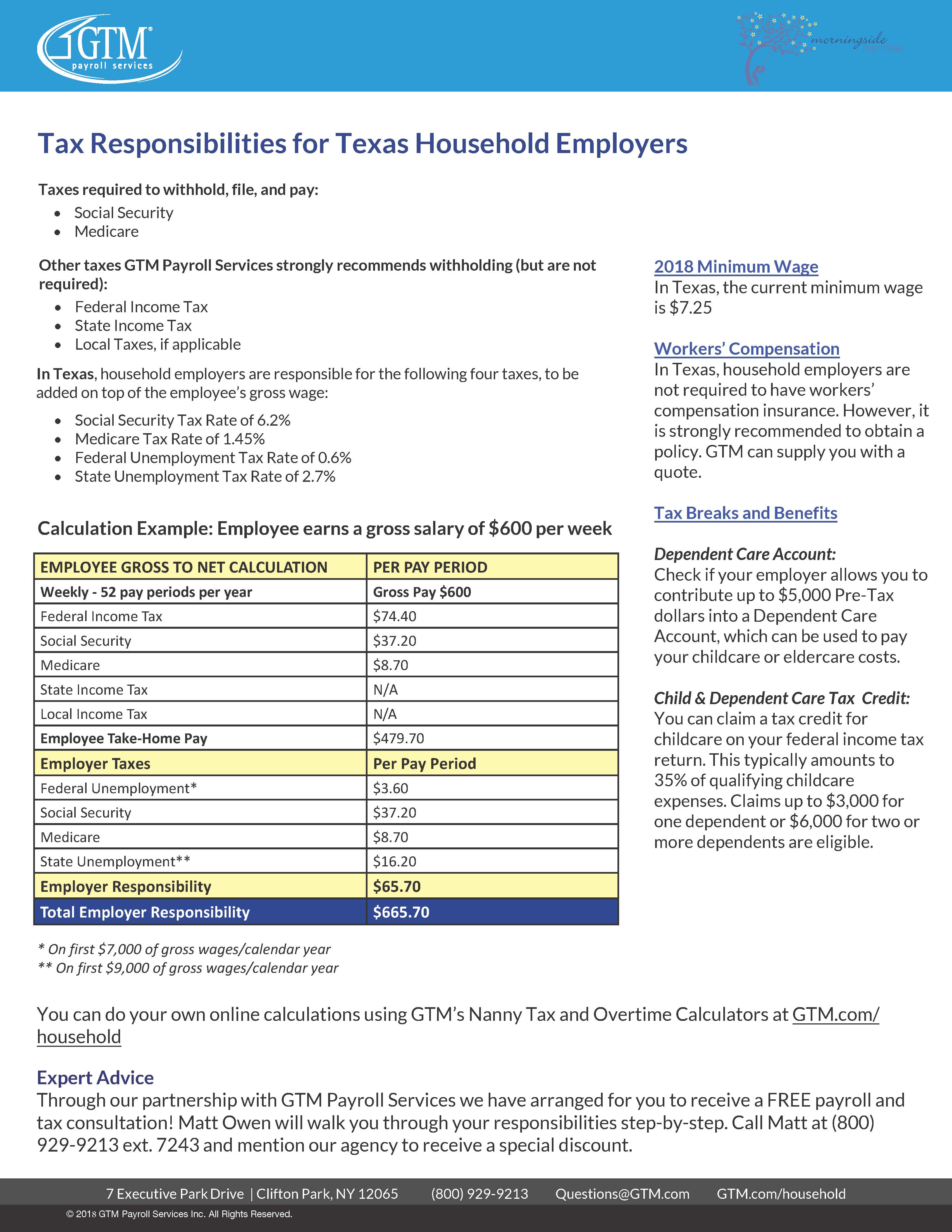

2018 Nanny Tax Responsibilities

Reimbursing Your Nanny For Gas Mileage Sittercity

Nanny Taxes How To Pay Taxes For A Household Employee

How To Professionally Terminate A Nanny Or Senior Caregiver Care Com Homepay

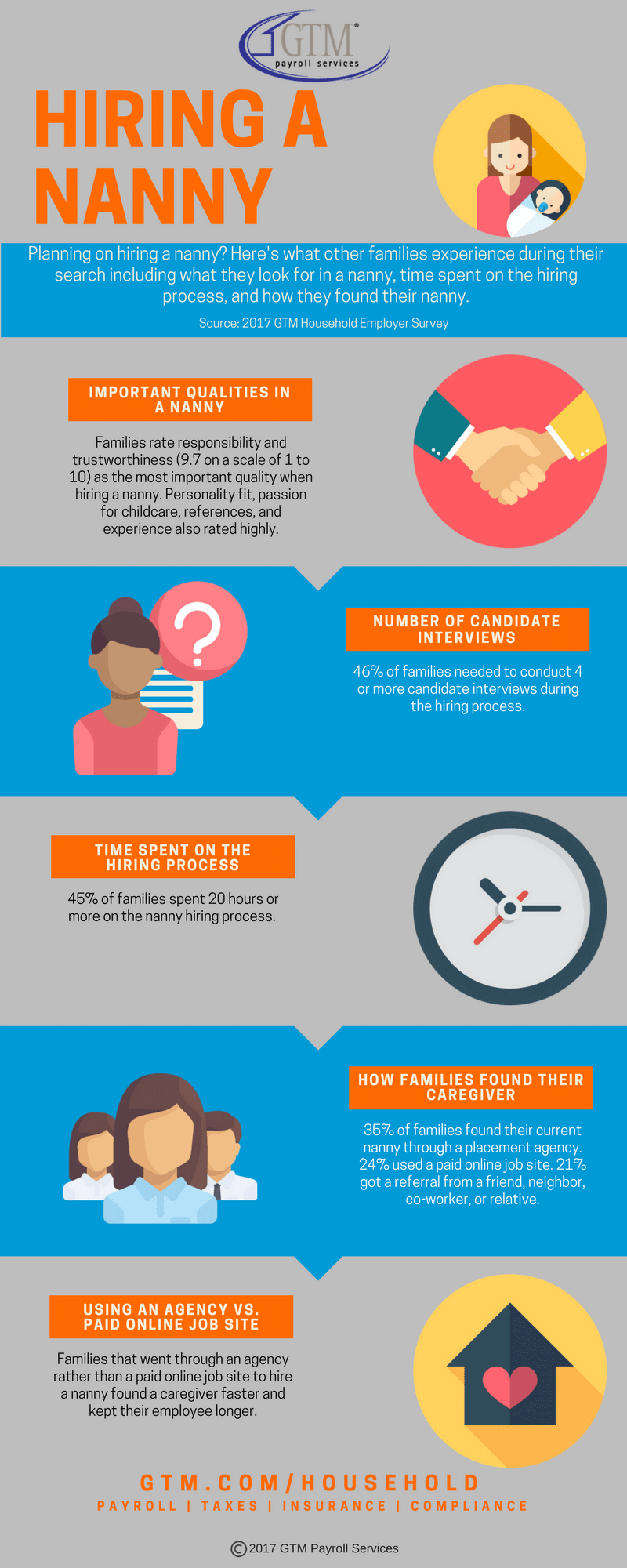

Planning To Hire A Nanny See What Other Families Experience

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom