north dakota sales tax exemption

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax. How to use sales tax exemption certificates in North Dakota.

Arizona Arizona State Of Arizona Arizona State

Not exempt Minnesota motels and hotels are not exempt North Dakota Ohio and West Virginia.

. Products Exempt from Sales Tax A. In general North Dakota doesnt grant nonprofits sales tax exemption. Signed by new owner with tax exemption and lienholder information if applicable.

Name and physical address of the project. The letter should include. We use cookies on this site to enhance your user experience.

Medical marijuana does not qualify for this exemption and is subject to sales tax. Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. Motor vehicles exempt from the motor vehicle excise tax under.

UND Status within State Government. Improvements to Commercial and Residential Buildings. Code 57-392-04 Exemptions ND.

North Dakota Sales Tax Exemption Certificate. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. 105-16413 Retail Sales and Use Tax Sales and Use Tax Bulletin see p.

The state government has instead written which kinds of organizations can qualify for state sales tax exemptions. Property Exempt From Taxation. The governments from states without a sales tax are exempt from South Dakota sales tax.

Now even with in-house dining once again on the table use of DoorDash Grubhub Uber Eats and similar platforms continues to grow. The rate of penalty. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

The gross receipts from sales of drugs that are sold under a doctors prescription for use by a person are exempt from sales tax. You will also need to pay a 5 title transfer fee 5 sales tax. 14-16 NC Directive.

North Dakota Form. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. It must be a new project or an expansion of an existing project.

Many states have special lowered. Not all sales are tax exempt. The North Dakota sales tax law provides for a sales tax exemption on machinery and equipment purchased by new or expanding manufacturers.

Remote sellers with no physical presence in North Dakota are required to collect state and local sales tax on taxable sales made into North Dakota unless they qualify for the small seller exception. Gail Cole May 18 2022. Title transfer fee is 5.

How do you remove a name from a North Dakota title when it is in two names or if one owner is deceased. North Dakota SSUTA ND. In addition agricultural commodity processors also may qualify for a sales tax exemption on building materials used to construct an agricultural commodity processing facility.

Sales Tax Exemptions in North Dakota. Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number. They are as follows.

These states are Alaska Delaware Montana New Hampshire and Oregon. Qualifying Veterans and Disabled Persons Confined. North Dakota provides sales tax exemptions for equipment and materials used in manufacturing and other targeted industries.

Diplomatic Tax Exemption Program. Public and private schools. You can download a PDF of the North Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page.

Exempt from North Dakota sales tax. No Sales Tax Exemption Available. North Dakota law includes an exception for small sellers that requires sales tax collection by remote sellers ONLY IF their taxable sales into the state exceed 100000 in the.

North Carolina North Carolina GS. This is a sales tax exemption for purchasing tangible personal property incorporated into a system to compress gather collect store transport or inject carbon dioxide for use in enhanced recovery of oil or natural gas or in secure geological storage in North Dakota. Homestead Credit for Special Assessments.

Ask Vendor before purchase. Farm Buildings and Other Improvements. Ohio Form Example.

Agricultural production equipment that qualifies as used farm machinery farm machinery repair parts used irrigation equipment and irrigation repair parts is exempt from sales tax when used. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by the seller.

Third-party delivery apps had a pretty good following before the COVID-19 pandemic heightened their appeal. Diplomatic Sales Tax Exemption Cards. No Sales Tax Exemption Available.

University of North Dakota DUNS Number 102280781. It allows suppliers to know that you are legally allowed to purchase the. South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to all.

Federal Tax Exemption Letter. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax.

Federal state and local governmental units. North Dakota sales tax. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

For other North Dakota sales tax exemption certificates go here. Other State Tax Exempt Certificates. A new or expanding plant may be exempt from sales and use tax on purchases of machinery or equipment used for manufacturing.

By clicking any link on this page you are giving your consent. Property Tax Credit for Disabled Veterans. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Property Tax Credits for North Dakota Homeowners and Renters. Medicine purchased without a prescription is subject to North Dakota sales tax. Use North Dakota Tax Exempt Certificate.

Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds. Third-party delivery apps can boost sales and sales tax complexity.

North Dakota And Indiana Are The Latest To Join The List Of States That Have Approved At Least A Part Retirement Income Military Retirement Benefits Income Tax

Printable North Dakota Sales Tax Exemption Certificates

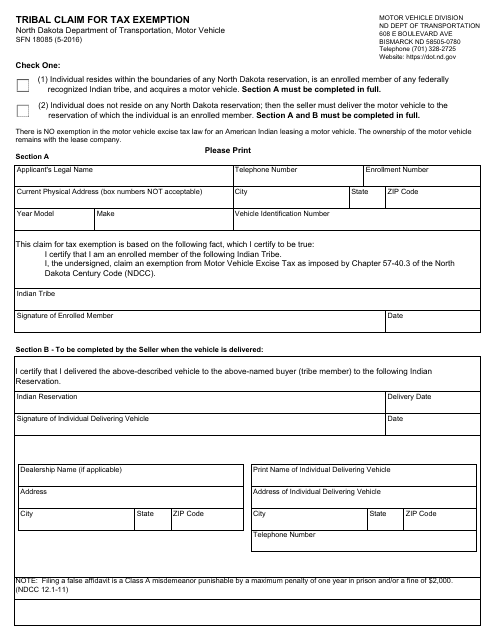

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Form Rv 093 Fillable Sales Tax Exempt Status Application

Tax Free Retirement Income For Life Guide Retirement Income Tax Free Life Guide

North Dakota Sales Tax Small Business Guide Truic

Financial Consultancy Services In Sharjah Accounting Services Financial Sharjah

Colorado Sales Tax Sales Tax Tax When You Know

12 Certificate Of Exemption Templates Free Printable Word Pdf Templates Templates Printable Free Template Free

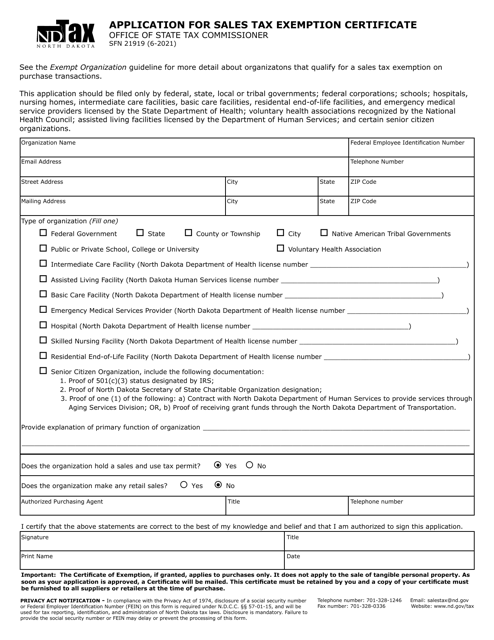

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Rapid City South Dakota By The Seeger Map Company Inc South Dakota Rapid City Rapid City South Dakota

Form 21919 Application For Sales Tax Exemption Certificate

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

North Dakota Sales Tax Exemptions Agile Consulting Group

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller